Buying a House in USA as an Expat

Are you ready to make your dream of owning property in the United States a reality?

Many foreign buyers find buying a home in the USA – known for its vast landscapes, vibrant cities, and diverse cultures – an attractive option.

From the atmospheric streets of New York City to California’s tranquil beaches, the USA offers a lifestyle that appeals to people worldwide.

The best part? As a foreigner, purchasing property here is not as complicated as you might think.

In fact, the process can be straightforward if you’re well-prepared.

Whether you’re seeking a vacation home, investment property, or planning a permanent move, owning real estate in the USA brings numerous benefits.

It can be a sound financial investment, with long-term appreciation potential, and opens the door to possible tax advantages and rental income opportunities.

With strong legal protections for property owners, you’ll enjoy peace of mind knowing your investment is secure.

This guide is designed to walk you through every step of the process, from choosing the perfect location to navigating legal requirements, ensuring that your journey to owning a home in the USA is smooth and rewarding.

So whether you’re chasing the excitement of a bustling city or the serenity of a quiet coastal retreat, you’re in the right place to learn how to make your American property dreams come true!

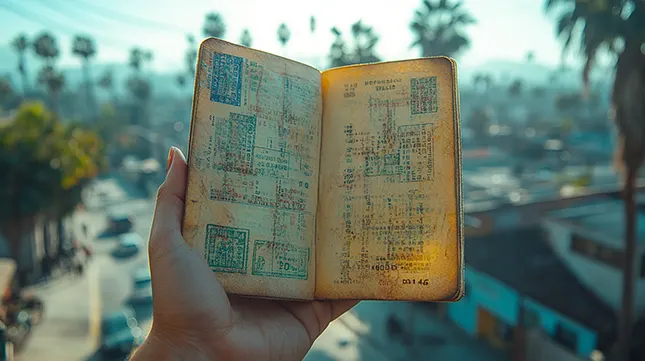

Visa Requirements for Buying a House in the USA

You will need to make sure you are applying for the correct visa.

Before seriously considering buying a house in the USA, it’s essential to secure the correct visa, especially if you plan on staying for extended periods.

For UK residents, visa types depend on several factors, including your reason for moving, professional skills, and family connections.

The most common visas for potential homeowners are employment-based visas, family-sponsored visas, and student visas, each with subcategories tailored to specific circumstances.

If your goal is to permanently relocate, obtaining a Green Card—granting permanent residency—should be a priority.

Navigating the U.S. visa process can be complex, but immigration experts can help you understand the options and ensure a smooth transition.

For comprehensive information on visa categories and application procedures, the US Embassy in the UK is an excellent resource.

Why Choose the USA?

There are a host of reasons British expats decide to move to the USA.

In addition to the financial and lifestyle benefits we outlined earlier, buying a house in the USA offers British expats a blend of comfort and adventure.

One of the most attractive aspects is that there’s no need to learn a foreign language, which makes settling in far easier.

However, while you may not have to master a new language, be prepared for local slang and colloquial expressions that might take some getting used to!

For many Brits, the familiar aspects of American life—like shared cultural references, similar legal systems, and even the same brands—provide a sense of ease.

You also won’t have to learn a new language. although it may be best to touch up on some of the local lingo!

Yet, the country also offers exciting new experiences unique to the USA.

You may be a student looking for education opportunities, a family seeking a new adventure, or someone planning for retirement, owning a home in America can open the door to a variety of exciting possibilities.

The Advantages of Buying a House in the USA for Expats

Expats are well placed to purchase their dream home without many restrictions.

British expats looking to invest in property in the USA will be pleased to know that buying a house in the USA is not restricted by citizenship or residency status.

This allows you to confidently explore the housing market, knowing that your dream of owning a home in America is entirely possible.

Purchasing property as a foreigner is generally straightforward, especially when you have expert guidance from a real estate agent specialising in international transactions.

One key benefit for British buyers is the opportunity to take advantage of the favourable exchange rate, making properties more affordable than domestic options.

Additionally, the US housing market is known for its stability and long-term growth potential, meaning your investment has the chance to appreciate over time.

Is Buying a Home in the USA a Good Financial Decision?

Evaluating whether a US property fits your financial capabilities and current market conditions is essential.

The US real estate market is vast, and trends vary significantly by region.

In 2024, the market presents both opportunities and challenges.

While property values continue to rise, the rate of growth has slowed.

Some experts predict mortgage rates might decrease soon, which could open doors for prospective buyers.

However, it’s crucial to monitor interest rates, regional housing supply, and economic indicators to make informed decisions.

For more detailed insights, visit resources such as the Homebuying Institute, which can help guide your investment choices.

Setting a Realistic Budget for Buying a House in the USA

Make sure you are realistic with your budget and expectations.

Before buying a house in the USA, setting a realistic budget is essential to ensure you can comfortably afford the upfront and ongoing costs of homeownership.

Start by assessing your current savings and any outstanding debts.

It’s important to plan for more than just the price of the house.

Factor in additional expenses such as the down payment, closing costs (typically ranging from 3% to 6% of the property’s value), property taxes, insurance, and routine maintenance.

Don’t forget the closing costs, which can add thousands of dollars to the final price and include fees for the title search, legal expenses, and property appraisal.

Property taxes and homeowner’s insurance vary by location and should be included in your monthly budget.

Regular maintenance, including repairs and upkeep, is another essential consideration to avoid unpleasant surprises down the line.

Creating a detailed budget gives you financial security as you proceed with your purchase.

Remember, a well-thought-out budget ensures that you can comfortably manage your ongoing expenses.

Can Foreign Buyers Get a Mortgage in the USA?

You will have to follow a few steps to get a mortgage in the US.

If you’re a UK citizen interested in buying a house in the USA, getting a mortgage is possible, though the process may differ slightly from what US citizens experience.

Many lenders are open to offering mortgages to non-residents, but requirements can be stricter.

You’ll typically need to provide a larger down payment—usually 25% to 50% of the property’s value.

Lenders will also want proof of income, employment history, and, potentially, your visa status.

If you don’t have a US credit score, don’t worry. Some banks, such as HSBC and First American Bank, offer specialised mortgage products for international buyers.

Getting pre-approved for a loan before you start house hunting is also a good idea, as this shows sellers you are a serious buyer with financial backing.

Additionally, explore the interest rates and loan terms, as they may be higher than those offered to US citizens.

Some foreign buyers pay in cash to avoid these hurdles, but if you need a loan, working with a real estate agent and mortgage broker with experience with international clients can simplify the process.

For more detailed guidance on securing a mortgage as a foreigner, check out HomeAbroad.

Should I Hire a Real Estate Agent

It is a good idea to hire a real estate agent if you are buying a house in the USA.

As a British expat in the USA, yes, you should.

Hiring a real estate agent experienced in working with international clients is crucial.

An agent with expertise in cross-border transactions will help you navigate the complex process of purchasing property in a foreign country.

One key credential to look for is whether the agent is a Certified International Property Specialist (CIPS).

This designation ensures they have advanced knowledge of global transactions and understand the unique challenges that foreign buyers face.

With their extensive understanding of local markets, they can provide insights into neighbourhoods that match your lifestyle and needs.

A seasoned agent will guide you through every step, from making an offer to finalising the deal, and offer advice tailored to your situation.

Their expertise can make all the difference in securing the perfect home in a location that suits you.

To determine if your chosen real estate agent is legitimate, visit the Certified International Property Specialist (CIPS) website.

Begin your Search for a Home

As the world’s third-largest country, America offers an extraordinary range of opportunities for foreign nationals to purchase their own homes.

Whether you’re drawn to urban lofts in cities like New York or spacious suburban homes in Texas, the diversity of the American real estate market means there’s something for every taste and budget.

One notable advantage is the generous size of American homes, which tend to be larger than their UK counterparts.

Many have spacious gardens and modern amenities, making them ideal for families or those seeking more space to live and grow.

If you already have a clear idea of your dream home, that’s great!

But even if you know what you want, it’s wise to list your must-have features and preferences before starting your search.

This will help your real estate agent focus on the best options for you and save you time, particularly if you’re searching from the UK.

Whether you prioritise neighbourhood vibe, school proximity, or home features like a large garden or modern kitchen, a clear list ensures an efficient search.

Ready to explore the endless possibilities? The American dream home you’ve envisioned could be just around the corner!

Next Step: Make a Reasonable Offer

When you’ve found the perfect home, the next step is to make a competitive offer.

Your real estate agent will play a crucial role here. They will use their knowledge of local market conditions to help craft an offer that appeals to the seller while protecting your interests.

Negotiation is a natural part of the process, and it’s common for sellers to counter your initial offer.

Don’t worry—your agent will handle these negotiations to secure the best possible price and terms for you.

Skilled negotiation can often lead to a great deal, especially if your agent is experienced in working with foreign buyers.

With their expertise, you’ll be well-positioned to achieve a desirable outcome that aligns with your budget and long-term goals.

Is a Property Inspection Necessary?

While not a legal requirement, a property inspection is certainly recommended.

No, a home inspection is not a legal requirement when buying a property in the USA.

However, it is highly recommended for buyers to protect their investments.

A home inspection allows the buyer to identify any potential structural or mechanical issues with the property before finalising the purchase.

While not mandated by law, many lenders require an inspection as part of the mortgage approval process, and most buyers include a home inspection contingency in their offer.

This means that the sale of the property is dependent on the inspection results, allowing buyers to renegotiate or walk away if significant issues are uncovered.

Even if the seller provides their inspection report, hiring an independent inspector is wise to ensure no problems are overlooked.

A certified inspector will assess the structural integrity of the home, including the roof, foundation, plumbing, electrical systems, and heating/cooling units

It is important to note that skipping the inspection could lead to costly repairs in the future, so it’s considered a necessary step in the home-buying process, even if not legally required.

For a more in-depth guide on why home inspections are essential, visit Zillow.

Paying USA Property Taxes

If you have undertaken your due diligence before submitting an offer on a home, you will already know there are taxes to pay when you purchase a home in the USA.

Here are the key taxes to be aware of:

- Property Taxes: Like US citizens, foreign property owners must pay annual property taxes based on the property’s value. These taxes are set by local governments (city or county) and can vary by location.

- Income Tax on Rental Income: If the property is rented out, the foreign owner must pay US income tax on the rental income. The tax rate depends on whether the owner opts for taxation under the Net Election, where expenses (such as repairs and maintenance) can be deducted, or if a flat 30% tax on gross income is applied.

- Capital Gains Tax: If the foreign owner sells the property for a profit, they must pay capital gains tax on the profit. The rate for foreign nationals is typically 15-20% depending on the amount of gain and how long the property was owned.

- FIRPTA (Foreign Investment in Real Property Tax Act): Under FIRPTA, foreign sellers are subject to a 15% withholding tax on the sales price when selling US property. This amount is withheld to ensure the foreign owner pays any applicable capital gains taxes.

It is helpful to refer to resources provided by the IRS (Internal Revenue Service). You can learn more about its functions at its official website: https://www.irs.gov.

Sealing the Deal: Final Steps When Buying a House in the USA

Make sure you follow all of the steps below to finalise your purchase.

You’re almost at the finish line of buying a house in the USA!

Now is the time to focus on closing the deal.

Before closing day, carefully review all the documents related to the sale.

This includes the purchase agreement, mortgage details, and other legal paperwork.

Again, your trusty real estate agent and lender will be there to clarify anything you don’t understand.

You will settle any remaining fees, such as closing costs, on the actual day of closing. These typically range from 3% to 6% of the property price.

Once all the paperwork is signed and finalised, you will officially own the property and receive the keys to your new home!

This final step makes your dream of owning property in the USA a reality, and you are now ready to move in and make it “Home Sweet Home”!

How to Discover Your Best Fit USA Location

Due to the country’s sheer size and diversity, finding the best place to live in the USA can be both exciting and overwhelming.

Whether you’re relocating for work, seeking a new lifestyle, or simply looking for a fresh start, choosing the right location is key to enjoying your new life.

Factors such as job opportunities, cost of living, climate, and quality of schools all play a crucial role in determining where you’ll feel most comfortable.

To make your search easier, consider what matters most to you—proximity to nature, access to vibrant city life, or a family-friendly community.

The tips below will help you navigate these considerations, narrow down your options, and find the perfect location for your next chapter.

- Consider Your Lifestyle Preferences

Think about what matters most to you: Do you prefer urban, suburban, or rural environments? Do you want access to the outdoors, nightlife, or cultural attractions? For example, New York City or San Francisco might suit you if you love the arts and fast-paced city life. If outdoor activities are your thing, places like Denver or Portland could be perfect.

- Job Market and Economic Opportunities

Research the job market in different regions. Some cities are booming in specific industries, such as tech in San Francisco, finance in New York, and healthcare in Boston. Make sure the location offers opportunities in your field of work.

- Cost of Living

Living costs vary widely across the USA. Cities like New York, San Francisco, and Washington D.C. tend to be more expensive, while cities like Austin, TX, or Raleigh, NC, offer a lower cost of living with a strong economy. Websites like NerdWallet’s cost of living calculator can help you compare locations.

- Climate Preferences

The USA also has a wide range of climates—from the sunny coasts of California and Florida to snowy regions in the Northeast and Midwest. Consider whether you prefer warm, temperate, or colder weather.

- Quality of Schools and Healthcare

If you have children or plan to start a family, the quality of local schools will be necessary. Similarly, consider access to healthcare facilities. Areas like Boston, MA, and the Research Triangle in North Carolina are known for excellent healthcare and education systems.

- Transportation and Commute

Evaluate the availability of public transportation and how far your potential home is from work or other essential locations. Larger cities like New York and Washington, D.C., have excellent public transit systems, while other areas might require a car.

- Crime Rate and Safety

Use online tools to research crime statistics in potential areas. Websites like NeighborhoodScout provide detailed crime rates and safety rankings to help you choose a secure place to live.

- Community and Social Networks

Consider whether you have friends, family, or a support network in the area. If you’re new to the USA, finding expatriate communities can help ease the transition. For example, cities like Miami and Los Angeles have strong international communities.

By balancing these factors, you’ll be able to find a location that matches your personal preferences and long-term goals.

Most Popular Locations in the USA for Expats

The USA is packed with wonderful places to live, check out some of the top picks.

The USA offers an extraordinary range of opportunities for foreign buyers.

Whether you’re drawn to the urban life of New York City, the tech-driven economy of San Francisco, or the beachfront living of Miami, there’s something for everyone.

Popular locations for expats include:

- New York City, NY: Cultural and financial hub with endless career opportunities.

- Los Angeles, CA: Sunny beaches and thriving entertainment scene.

- Austin, TX: Fast-growing tech industry and lively community.

- Miami, FL: Warm climate and a multicultural lifestyle.

- San Francisco, CA: Known for its rolling hills, Golden Gate Bridge, and tech-driven economy.

Be sure to assess factors like job markets, cost of living, climate, and school quality when deciding on a location.

Moving Your Household Effects to the USA

Once everything is in place and you are sure where you want to settle, the next stage of your USA journey is planning for the arrival of your belongings.

Buying a house in the USA as a foreigner and arranging shipment of your effects can be daunting, but it need not be.

Enlisting the services of a professional international removal company such as White & Company will help immensely.

Having been in operation for well over 150 years, we understand that moving is stressful, especially when it comes to a new home thousands of miles away.

All you need to do is give us a call, fill in our online quotation form or interact with our BOT, it is as simple as that.

We will book an appointment for a home visit or, if you prefer, a virtual survey, whichever suits you best.

Following the survey, you will receive our free-of-charge “no obligation quotation” for your move.

We are long-term members of the British Association of Removers for your added security and peace of mind. As highly respected regulators of the removal industry, members must adhere to the strictest of standards.

So, why not let White & Company help make your international move a positive experience?

Max is a seasoned writer and blogger in the real estate and home moving sectors, as well as a knowledgeable source of information for expatriates living and working abroad. His detailed insights have helped thousands of people move and live abroad with greater simplicity and ease.

Posted in: News

Leave a Comment (0) ↓